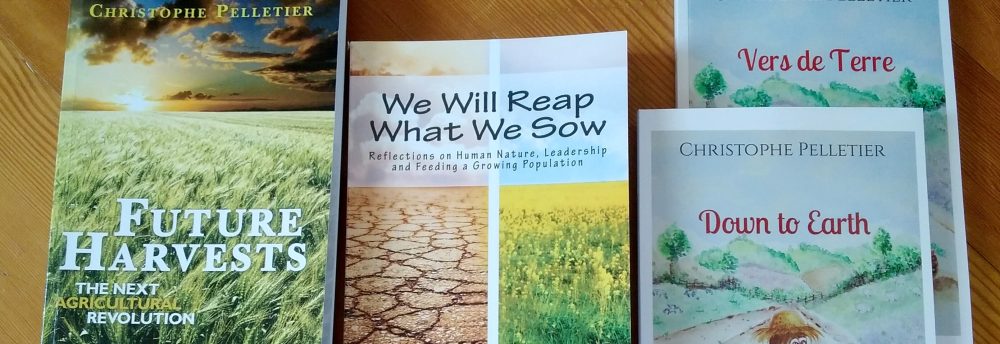

Last May, when the Chinese company Shuanghui announced it was buying Smithfield Foods, the world’s largest pork producer, I was very curious to read about reactions to the news, in particular from the US. The takeover did not surprise me. In my second book, We Will Reap What We Sow, I already told my expectation that the geography of corporations would change, following the shift of economic power around the world. I predicted that the new emerging powers would take over some of today’s agribusiness beacons, and hinted that eventually, headquarters of large corporations would also move to locations closer to the bulk of consumption. The Smithfield takeover quite fits in this scenario. My interest in the reaction of Americans came from some of my earlier speaking engagements. At the beginning of my activities with The Food Futurist, I presented in several occasions how the rise of the Asian middle class would affect markets. In particular the magnitude of the Chinese market always put things in perspective. When I showed my audiences how much volume an increase of 10 kg per capita per year of beef, pork and chicken would represent, there was usually a silence of surprise. Then, when I told that the evolution is not just about volume but also about the choice of cuts, that instead of being complementary to Western consumption by buying low quality cuts, the Chinese market would become a direct competitor for the same pieces of meat, the surprise usually turned into annoyed denial. The price of the meat that Americans would buy would be set by the consumers in Beijing and Shanghai at least as much as by those in New York or Los Angeles? That’s bold, isn’t it? I could understand the reactions. After all, the coming situation would mean the end of the undisputed dominance of American stomachs (and to some extent, their minds as well). The highest bidder will get the best product. It is not just a hunch about the future. It is the here and now. There are already examples of that in the seafood sector, where the top quality products are shipped to China instead of ending on French tables as it used to be, simply because the Chinese buyers are willing to pay more than the French to get the product, probably because they still make very good money at those prices.

However, many reactions from the US have been the ones I expected. I could find outrage at the idea that a Chinese company could dare buy an American one. I do not remember seeing such opposition when Brazilian meat companies would buy Western ones, but after all Brazil is not perceived (yet) as a contender to the US supremacy as China is. That would explain the double standards, I suppose. There were the extreme reactions such as those who decided and claimed they would not eat meat from Smithfield because, according to their simplistic conclusions, their pork would sink to the quality standard of what they think Chinese products are. Well, no… because applicable food standards in the US would still be those of the USDA and not from the Chinese government. How simplistic they may sound, such reactions are not from average Joe. They come from comments posted on professional meat magazines for which readers need to subscribe. The world is changing, but some still hope the old status quo will prevail. Good luck with that!

Yes, there will be competition for the attractive cuts of meat. Actually, it will shape the coming couple of decades of global agriculture, and of agricultural markets. Prices will depend on the ability to forecast and align production and consumption of animal products with commodities for animal feed. There is much work needed in that area. Those who attended my presentations in which I mention the dynamics of future markets know what I mean.

But there are more lessons from the Shuanghui-Smithfield merger, beyond the simple competition for the carcases and the geography of purchasing power. It sends a clear signal that the Chinese market is evolving towards more quality. The local suppliers want to be able to provide the market of the increasing affluent Asian middle class with the same standards as Western markets, which I have been also indicating as a growing trend both in my writings as in my presentations. Purchasing a company such as Smithfield offers Shuanghui the possibility to speed up the learning curve towards a better pork quality by also buying the processes and procedures that already exist in the production units in North America and Europe. Such a move is going to have interesting ripple effects. Normally, it should give Shuanghui a competitive advantage, as they should learn and implement better procedures faster and better than their Chinese competitors. This will give them a strong position in the urban centers, at least in the short term. In the long term, the side effect is that their competitors will also work harder at raising their own standards and improve food quality in China. This will also indirectly serve the Chinese governments by having market forces working in the same direction as government regulations to achieve better food standards. Finally, it will benefit the Chinese consumers, as they will be able to buy better quality foods. As they became wealthier, Chinese consumers have also become more critical and aware of environmental and food safety issues. They will not accept the current situation anymore and they want the same top quality as the Westerners. After all, the income in large Chinese urban center is quite similar to the one of Westerners. Why should they settle for less? And in the future, we will see the same trend growing in other emerging countries. That is where the best opportunities will arise in the coming decades.

Copyright 2013 – The Happy Future Group Consulting Ltd.

This group will continue to be involved in mass production of commodities for global supplies, like this is the case today.

This group will continue to be involved in mass production of commodities for global supplies, like this is the case today. This sector should undergo a strong growth and be build in a market-driven approach. These are the farmers that produce specialty products aimed at serving either a very specific segment of the retail or foodservice market.

This sector should undergo a strong growth and be build in a market-driven approach. These are the farmers that produce specialty products aimed at serving either a very specific segment of the retail or foodservice market. In emerging countries, the development of a local agriculture, and aquaculture, will be a key driver of economic development for under industrialized and/or under urbanized regions. It also will be a way of slowing down the migration of population to urban centers and limit social problems, by creating satisfying economic conditions and by securing food supplies locally. This farming will be about basic needs, before marketing.

In emerging countries, the development of a local agriculture, and aquaculture, will be a key driver of economic development for under industrialized and/or under urbanized regions. It also will be a way of slowing down the migration of population to urban centers and limit social problems, by creating satisfying economic conditions and by securing food supplies locally. This farming will be about basic needs, before marketing.