Here is a topic that I have started to address quite a long time ago, long before it got popular with the bobos. Actually, it became popular only after the mainstream media got knowledge of the UN FAO views on insects as a source of food for people in the future.

The main thing I hear regularly about insects and worms is the “yuk” effect. Yuk is mostly a western countries’ issue. In Asia and Africa, insects and worms are actually quite popular. I can understand that crawlies might not look as appetizing as a steak, but I always like to bring some perspective by showing other foods considered delicacies in western countries that are not all that different from insects, such as lobster, shrimp or snails. People are willing to pay a steep price for those. There is a difference, though: the flesh ratio of lobster, shrimp, langoustines, snail, crab and similar creatures is much higher than that of crickets, for instance. It is also true that Westerners prefer meatiness, while many Asian cultures like crunchy and having to chew and suck the flesh out of the shell or off the bones. Nonetheless, insects are not all that bad. Worms are actually much meatier than insects and why would they not follow the path of snails. As you may know, I was born and raised in France, which is often viewed as a country of snail eaters. It is true to same extent, but here is some history about snails as food in France. First thing to realize is that snails were eaten commonly in times where other animal proteins were not abundant and expensive. Those who could not afford meat would look for alternatives. Snails were one option. Another was… guess… frogs found in ponds! But the French would not eat just any snail. After all, they were French and therefore discriminating about food. Two types of snails were popular because of their meatiness: the “Petit Gris” (Little Grey) and the Escargot de Bourgogne (Burgundy Snail), the latter being rather big and meaty. As you probably know, the British would be disgusted at the idea of eating snails (the “yuk” thing), until the wealthier decided that it was fashionable to eat “escargots” instead. Yes, it tastes much better when you say it in French. So maybe all that needs to happen is for the snobs, bobos and other hipsters to decide to eat exotic insects and worms in the language of their (the insects’ and worms’, not the snobs’) country of origin. And they already do but it is a small niche. I can find some insects around but the price per pound is even higher than caviar, so no thank you! That is what frustrates me about many of those start-ups. And understand me well, I am all for innovation and entrepreneurship. I believe money should be the reward for a job well done, not the end for just a promise that has not yet materialized. Despite all their nice claims to save the world, the environment and being so incredibly responsible about everything, they are actually interested primarily in trying to score financially and be sold to a large corporation that will be willing to overpay for their shares based often on a concept that still needs to prove itself, but after all why not. But to do that, they actually lock themselves in small niches in such a way that there are only two ways to move forward: one is to stick to high margin pricing and have little growth possibilities, the other is to slash the prices to get more volume moving but often transforming the specialty into a commodity. What other reason would there be to focus on Western markets that say “yuk!” while there is a huge potential in Asia and Africa but for lower margins? You guessed it: pleasing the shareholders who want sell their shares and cash in as soon as possible.

Anyway, human nutrition is only part of the equation. Just like snails were an alternative for lean times in France, the consumption of insects and worms in parts of today’s world are also an alternative to other animal protein too expensive to buy. You can bet that when given a choice, many insects and worm eaters will choose for a juicy steak. Human consumption of food is not all that much led by sound rational nutrition. If we were all rational with food we would 1) eat balanced meals, 2) we would not overeat day after day to get ourselves in debilitating diseases and 3) we would not waste some much food. So, we are not rational, and that is the main difference between human food and animal nutrition (except for pets, for which we have decided to introduce the same irrationality with the same consequences for our furry friends). Animal nutrition is all about meeting properly the nutritional needs of the animals, never let them overeat and not waste any feed because it just costs money to the farmer. Actually, animal nutrition should be an example for humans in many respects. The difference between humans and cows, pigs, chickens and fish is that the animals do not put any psychology in their food. They eat to live and they do not live to eat… mostly. This is why I have said for years that I think insects have their highest potential as an ingredient for animal feed, well, as long as the price is competitive with other alternatives.

Here are some clues why feeding insects and worms to animals makes perfect sense. First, here is some wisdom from anglers. What bait do they use when they go fishing for trout for instance? They use a decoy that looks like a fly, because they practice fly fishing, and they use the fly because fish eat flies, and other insects! It is just this simple. Fish feed producers are currently going this road. Another example is about a customer of mine when I used to work in the poultry business. He was from the UK and when the “mad cow” disease hit in the UK in 1996, discussions turned about eliminating meat and bone meal from animal feed, as the suspect reason of transmission was the use of contaminated meat and bone meal produced in rendering plants containing sheep infected with scrapie, a disease. Meat and bone meal was used because it has a high protein content, good nutritional value and it worked fine for many years. Nonetheless after the mad cow crisis, meat and bone meal had to be removed and my customer told me with a straight face (remember that he was the managing director of a poultry company) that there was no reason to put meat and bone meal in chicken feed because chickens are vegetarians. Isn’t that a disaster to have disconnected people from Nature (I wrote an article a long time ago about this topic)? Chickens are vegetarians. Yeah, right. Anyone who has seen chickens roaming around a farm yard will tell you that they eat worms and insects. They are not vegetarian at all. Actually, in spite of many claims of people opposed to animal farming and meat, it is difficult to find a species of monogastric (one-stomach species, like humans, pigs or poultry) that does not consume animal protein. Usually, all the species that they mention as being vegetarians are polygastrics (digestive tract consisting of several stomachs, like ruminants) which have the ability that monogastrics do not have to eat grass and other cellulose-rich materials and being able to transform them into meat and milk as I mentioned in my article about “cow farts”. Anyway, back to my friend (because we became good friends –we are still in touch from time to time after 20 years or so) from the UK and his vegetarian chickens, I replied that not only chicken do eat worms and insects but worms process dead material, kind of like a rendering plant. Well, that was a bit awkward and the real reason came up. It was much better to tell me that his customer would not want chicken meat from animals fed with meat and bone meal and that it was final, and that he needed me to go along with that. Although not quite rational, that was a better reason than the bogus vegetarian chicken argument. His customer, a leading UK retailer had strong views about animal feed. Among their arguments was that feeding ruminants, which are vegetarian from nature, with animal protein was comparable to cannibalism; or that using fish meal could be acceptable only the day they would see a cow grabbing a fish out of the water to eat it. Such arguments were partly emotional of course, but had some rooting in good old-fashioned common sense, which I would never blame anyone for using. So, use good common sense and also solid factual science to feed yourself. It is not mutually exclusive and it does not stop anyone from being a true gastronome. You can take me as an example of that, as it is another brand of mine, The Sensible Gourmet!

Here are some clues why feeding insects and worms to animals makes perfect sense. First, here is some wisdom from anglers. What bait do they use when they go fishing for trout for instance? They use a decoy that looks like a fly, because they practice fly fishing, and they use the fly because fish eat flies, and other insects! It is just this simple. Fish feed producers are currently going this road. Another example is about a customer of mine when I used to work in the poultry business. He was from the UK and when the “mad cow” disease hit in the UK in 1996, discussions turned about eliminating meat and bone meal from animal feed, as the suspect reason of transmission was the use of contaminated meat and bone meal produced in rendering plants containing sheep infected with scrapie, a disease. Meat and bone meal was used because it has a high protein content, good nutritional value and it worked fine for many years. Nonetheless after the mad cow crisis, meat and bone meal had to be removed and my customer told me with a straight face (remember that he was the managing director of a poultry company) that there was no reason to put meat and bone meal in chicken feed because chickens are vegetarians. Isn’t that a disaster to have disconnected people from Nature (I wrote an article a long time ago about this topic)? Chickens are vegetarians. Yeah, right. Anyone who has seen chickens roaming around a farm yard will tell you that they eat worms and insects. They are not vegetarian at all. Actually, in spite of many claims of people opposed to animal farming and meat, it is difficult to find a species of monogastric (one-stomach species, like humans, pigs or poultry) that does not consume animal protein. Usually, all the species that they mention as being vegetarians are polygastrics (digestive tract consisting of several stomachs, like ruminants) which have the ability that monogastrics do not have to eat grass and other cellulose-rich materials and being able to transform them into meat and milk as I mentioned in my article about “cow farts”. Anyway, back to my friend (because we became good friends –we are still in touch from time to time after 20 years or so) from the UK and his vegetarian chickens, I replied that not only chicken do eat worms and insects but worms process dead material, kind of like a rendering plant. Well, that was a bit awkward and the real reason came up. It was much better to tell me that his customer would not want chicken meat from animals fed with meat and bone meal and that it was final, and that he needed me to go along with that. Although not quite rational, that was a better reason than the bogus vegetarian chicken argument. His customer, a leading UK retailer had strong views about animal feed. Among their arguments was that feeding ruminants, which are vegetarian from nature, with animal protein was comparable to cannibalism; or that using fish meal could be acceptable only the day they would see a cow grabbing a fish out of the water to eat it. Such arguments were partly emotional of course, but had some rooting in good old-fashioned common sense, which I would never blame anyone for using. So, use good common sense and also solid factual science to feed yourself. It is not mutually exclusive and it does not stop anyone from being a true gastronome. You can take me as an example of that, as it is another brand of mine, The Sensible Gourmet!

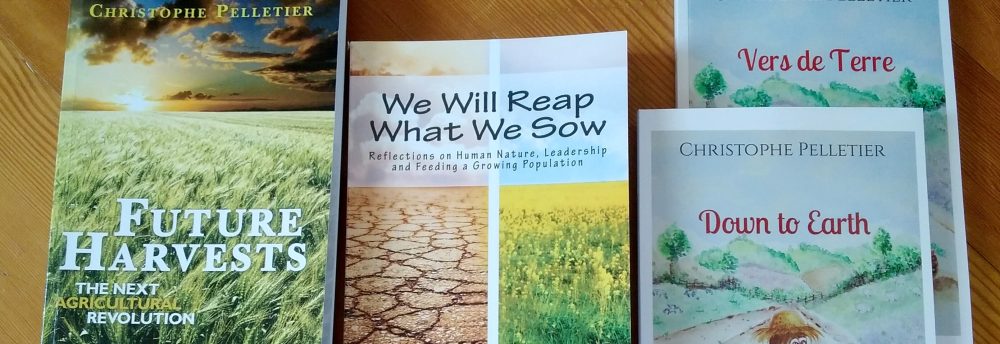

Copyright 2020 – Christophe Pelletier – The Happy Future Group Consulting Ltd.

fact, they will hardly listen. Therefore, words will have little impact, unless they go along with actions that confirm that the message is true. If the food industry does not want to change and hopes that communication will be enough to change the public’s mind, nothing will change. When you want someone to prove to you that he/she is reliable, you want to see tangible proof that something is changing in your favor. The most powerful communication tool that really works for regaining trust is the non-verbal communication. The distrusted one must sweat to win trust back. This does not take away that verbal communication must continue. It will keep the relationship alive, but it will not be the critical part for turning around the situation.

fact, they will hardly listen. Therefore, words will have little impact, unless they go along with actions that confirm that the message is true. If the food industry does not want to change and hopes that communication will be enough to change the public’s mind, nothing will change. When you want someone to prove to you that he/she is reliable, you want to see tangible proof that something is changing in your favor. The most powerful communication tool that really works for regaining trust is the non-verbal communication. The distrusted one must sweat to win trust back. This does not take away that verbal communication must continue. It will keep the relationship alive, but it will not be the critical part for turning around the situation.